In 2007 Kathy and I needed to buy a new home. We had banked with the National Australia Bank for over fifteen years, so it never occurred to us to go anywhere else. This would be our fourth home loan with the NAB. All of our previous loans had been at the variable rate, or with very short fixed terms. This time we had no idea how long it would be before we needed to move again, so the flexibility of a variable rate loan was even more important.

We met with bank staff twice, and explained our needs. We were especially careful to make it clear that we did not know how long it would be before we needed to sell, and that we needed as much flexibility as possible. We finally agreed to a fixed term of one year, then moving to the standard variable rate.

Documents were given to us to sign with representations that they expressed the agreement we had made. Because we had banked with the NAB for so long we had no reason to doubt what we were told. But six weeks ago, we found that the documents we had been given did not express the agreement we had made. Instead of a loan with maximum flexibility, we had been signed up for the exact opposite; a loan with a higher interest rate, for a fixed term of ten years.

When we discovered this, we assumed it had been an honest mistake, and that the bank would be anxious to fix it. We could not have been more wrong. The reaction to our concerns was hostility, delays, and finally an outright refusal to consider anything we said. We even told them we did not want back the extra interest they had charged us, we just wanted the mistake, their mistake, to be fixed, now that it had been discovered.

We have been defrauded of between $3000 and $4000 over the last four years. The National Bank also tells us that instead of being able to pay out the loan or refinance with minimal costs, they will charge us nearly $8000 to make any changes, on a loan of just over $100,000.

We should have done more homework before going to the National Bank. In 2003 popular independent consumer website notgoodenough.org noted that the NAB was the most complained about of any Australian company. Not just the banks. The National Bank was the most complained about of any Australian company.

Ten years later, nothing much has changed. There have been media reports of NAB staff making statutory declarations they knew to be false, of falsifying loan documents, and of a pattern of complete disregard for the rights of their clients. See, for example, the website ihatethenab.com, or Bruce Ford’s bankdispute.com.au

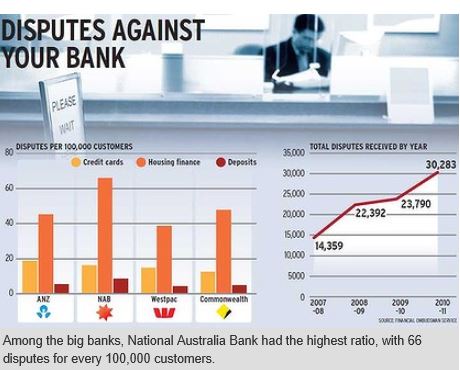

This is not just one or two disgruntled customers. As this graph from businessday.com.au shows, the National Bank continues to lead the industry in the number of complaints. The majority of those complaints relate to housing finance.

The National Bank can get away with treating its customers poorly, even dishonestly, because it knows that small customers like us do not have the funds to pursue justice through the courts.

What we can do, though, is to warn our family and friends. And that includes you.

If you bank with the NAB, for your own sake, change now.