The Australian Royal Commission into banking malpractice is considering submissions now, so it seems an appropriate time to link back to my story from 2012 about our own very special experience with the NAB (National Australia Bank).

“In 2007 Kathy and I needed to buy a new home. We had banked with the National Australia Bank for over fifteen years, so it never occurred to us to go anywhere else. This would be our fourth home loan with the NAB. All of our previous loans had been at the variable rate, or with very short fixed terms. This time we had no idea how long it would be before we needed to move again, so the flexibility of a variable rate loan was even more important.

We met with bank staff twice, and explained our needs. We were especially careful to make it clear that we did not know how long it would be before we needed to sell, and that we needed as much flexibility as possible. We finally agreed to a fixed term of one year, then moving to the standard variable rate.

Documents were given to us to sign with representations that they expressed the agreement we had made. Because we had banked with the NAB for so long we had no reason to doubt what we were told. But six weeks ago, we found that the documents we had been given did not express the agreement we had made. Instead of a loan with maximum flexibility, we had been signed up for the exact opposite; a loan with a higher interest rate, for a fixed term of ten years.

When we discovered this, we assumed it had been an honest mistake, and that the bank would be anxious to fix it. We could not have been more wrong. The reaction to our concerns was hostility, delays, and finally an outright refusal to consider anything we said. We even told them we did not want back the extra interest they had charged us, we just wanted the mistake, their mistake, to be fixed, now that it had been discovered.”

At the time I wrote that story, we had already been defrauded of between $3000 and $4000 in excess interest over a five year period. The National Bank also told us that instead of being able to pay out the loan or refinance with minimal costs, they would charge us nearly $8000 to make any changes, on a loan of just over $100,000.

Three years later, when we finally decided that despite the cost, we could no longer do business with an organisation so completely contemptuous of its customers, we had to pay some $3,000 in fees to the NAB for early release from the loan. Frustratingly, this was at the same time as the NAB was spending a fortune on TV ads claiming to be able to liberate people from locked in home loans with other banks, on the promise that its own loans were completely flexible. Hypocrisy is a grossly inadequate word to describe the National Bank’s attitude.

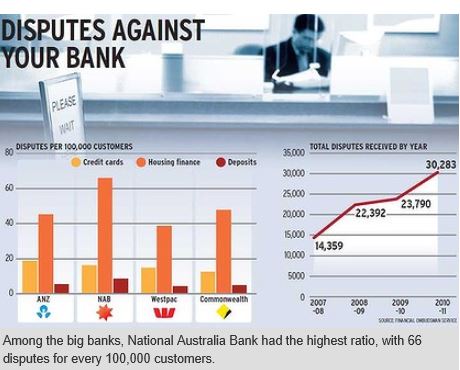

Nothing much has changed since this graph was published by business day more than ten years ago:

National Australia Bank Leads in Customer Complaints

It is not too late to make submissions to the banking Royal Commission. I plan to. A strong and profitable banking sector is vital to our economy. But for too long in Australia banking malpractice has been common, with banks like the NAB using their size and power over consumers in an immoral and bullying fashion. Time for some accountability.

Leave a Reply